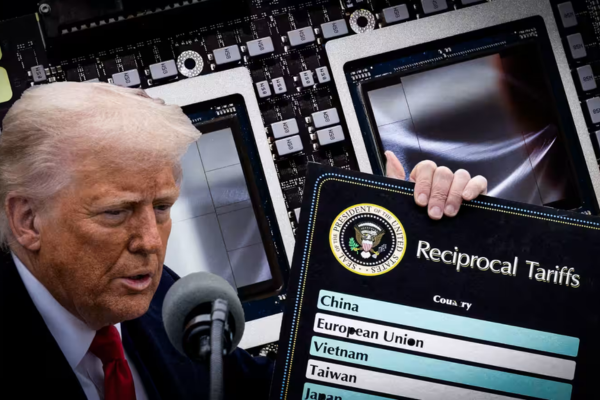

The likely winners and losers from Trump’s threatened 300% chip tariff

By YiFan Yu

Introduction

The Trump administration is preparing to impose tariffs on semiconductor imports, potentially as high as 300%, following a national security investigation. This move aims to incentivize companies to reshore chip manufacturing to the United States.

Key Points:

-

Widespread Impact: Analysts warn that the cost of tariffs will likely be passed through the supply chain, leading to higher prices for tech products and consumer goods in the US. A study estimates a 25% tariff could slow US economic growth.

-

Exemptions for US Investment: The administration has signaled that companies like Apple and Nvidia, which have committed to major US manufacturing investments, may be exempt from the tariffs. This is seen as a strategic tool to force companies to build domestic production.

-

Uncertainty for Foreign Giants: Asian chipmakers like TSMC and Samsung, which are already building US facilities, may face a higher bar for exemptions because they are foreign entities, potentially requiring further investment commitments.

-

Challenges for Some Chipmakers: Manufacturers of older, low-margin chips may find it economically unfeasible to shift production to the US due to high costs and a lack of existing supplier infrastructure.

-

Potential Beneficiary: Intel: The tariffs could provide a significant advantage to Intel by pressuring tech companies to use its US-based foundry services to avoid import levies, helping it compete against TSMC and Samsung.

Tencent to bring more AI services to Japan, Southeast Asia: executive

By Itsuro Fujino

Introduction

Chinese tech giant Tencent is planning a significant international expansion of its generative artificial intelligence (AI) services, targeting markets in Japan and Southeast Asia. The strategy involves leveraging technology and services refined and proven within China.

Key Points:

-

Market Focus: The company identifies Japan and Southeast Asia as ideal first markets due to their stability and geographic proximity to China.

-

Product Offerings: Tencent plans to introduce several services abroad, including:

-

AI Agents: Automated systems that can perform tasks independently, already used internally and by corporate clients in China.

-

Corporate AI Platform: A tool for businesses to develop their own custom AI agents.

-

Existing Tools: Services like AI-powered video advertising and palm biometric authentication, which are already being rolled out.

-

-

Competitive Edge: Tencent argues that the era of competing solely on large language models (LLMs) is over, noting a fierce price war among hundreds of models in China. Instead, it emphasizes:

-

Integration and Value: The importance of overall service design and adding value, where the LLM itself is only a fraction of the final product.

-

Internal Use-Cases: Its vast portfolio of apps (like WeChat) provides a massive internal testing ground to improve its AI competency, which it can then offer to customers.

-

-

Commercialization Focus: Tencent believes the true value of AI will be realized in specific industry applications—the “last mile”—such as improving operational efficiency in travel and manufacturing, where the benefits are clear and tangible.

Xiaomi’s latecomer EV business on track to turn a profit this year

By Itsuro Fujino

Introduction

Chinese tech giant Xiaomi has announced an ambitious goal to achieve profitability in its electric vehicle (EV) business as early as the second half of 2025, just over a year after its market entry. This rapid path to profitability is rare in the capital-intensive EV industry.

Key Points:

-

Strong Financials & Ambitious Goals: Driven by robust EV sales and a government subsidy program for electronics, Xiaomi’s Q2 2024 group revenue and net profit hit record highs. Despite an operating loss of 300 million yuan in its auto segment, President Lu Weibing projected quarterly or monthly profitability for EVs in late 2025.

-

Successful EV Launch: The company’s SU7 sedan and YU7 SUV have been highly successful, garnering hundreds of thousands of pre-orders. Xiaomi leverages China’s mature supply chain to achieve a impressive gross margin of 26.4%, surpassing industry leader BYD.

-

Significant Challenges: Its rapid success has created major hurdles:

-

Production Bottlenecks: Extremely long delivery wait times (34-58 weeks) risk losing customers to competitors.

-

Customer Service Issues: Reports have emerged of pressured advance payments and disputes with dealerships, potentially harming its brand reputation.

-

-

Broader Business Context: While its IoT and appliance sales surged to a record high (boosted by air conditioner and washing machine sales), its core smartphone revenue slightly declined. The company has also lowered its 2025 smartphone shipment target due to global economic uncertainty affecting the low-end market.

Asahi Kasei to double chip material production, tapping into AI boom

By Emi Okada

Introduction

Driven by the explosive global demand for artificial intelligence (AI) and data centers, Japanese chemical and materials companies are aggressively increasing capital investment to expand production of essential components.

Key Points:

-

Asahi Kasei’s Major Investment: The chemical maker is investing 16 billion yen ($108 million) to double its production capacity of Pimel, a key insulating material used in advanced semiconductors like GPUs. Its main customer is TSMC, and it aims to have new production lines operational by 2028 to meet demand that has already exceeded expectations.

-

Industry-Wide Trend: This investment is part of a larger surge in spending across Japan’s materials sector to support data center infrastructure:

-

Fujikura is investing 45 billion yen in new fiber optic cable plants.

-

Sumitomo Electric increased its investment in optical device production to 19 billion yen.

-

JX Advanced Metals is spending 1.5 billion yen on wafers for communications devices.

-

JFE Steel plans a sevenfold increase in production capacity for transformer steel.

-

-

Massive Market Growth: This expansion is a direct response to projections that global data center investment will grow 160% to $1.2 trillion by 2029, creating soaring demand for everything from semiconductors to wiring and power equipment.

Copyright 2025 Nikkei Asia. All Rights Reserved.

Contact us via email for more information.